Monese is a Europe-wide mobile app alternative to a bank, tackling financial inclusion and financial volatility. Monese is open to all, and focusses on helping striving families to manage their money and boulster their financial stability.

At Monese I’ve navigated some of the biggest challenges of my career so far. Joining the business in september 2015 in its early seed stage, I became the sole product designer in early 2016. From here I laid the foundations of the Monese product and visual design, hired, grew and lead the design team to a height of 19 amazing designers across 3 countries.

I implemented a series of design practices including design sprints and ideation sessions, design critiques, user testing, design system and documentation libraries with regular system catchups to keep knowledge sharing flowing, and maintain speed and consistency across the product org as we scaled.

Working closely with agile teams across the product, including User Researchers, Designers, Engineers, Product Leads and Data Scientists, we collectively pursued the goal of measuring and improving the customer experience and driving key business metrics such as growth, revenue and retention.

Designing the product

And setting standards

Scaling the team

Both expansion & contraction

Design Leadership

Direction & support

Strategic planning

To improve the experience

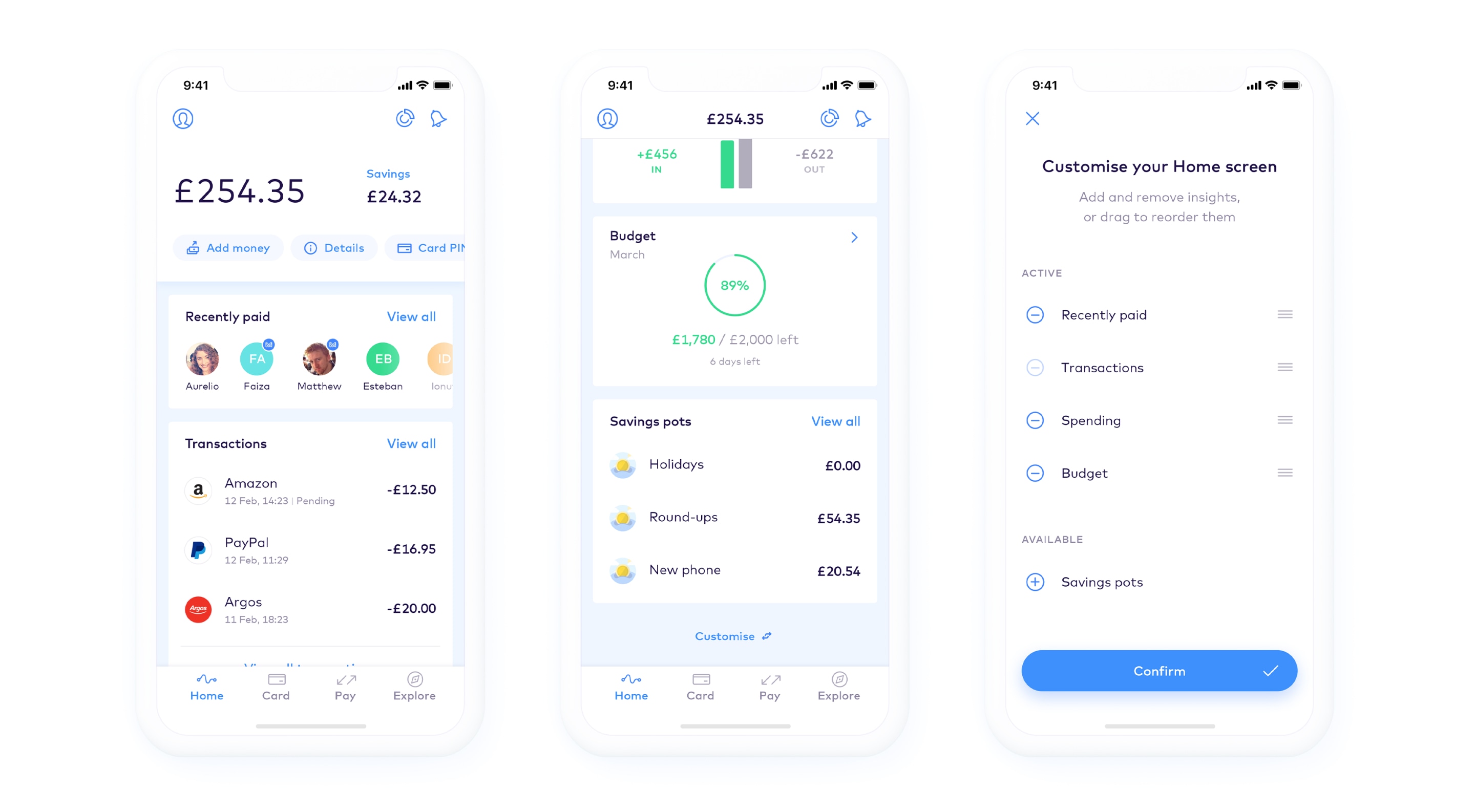

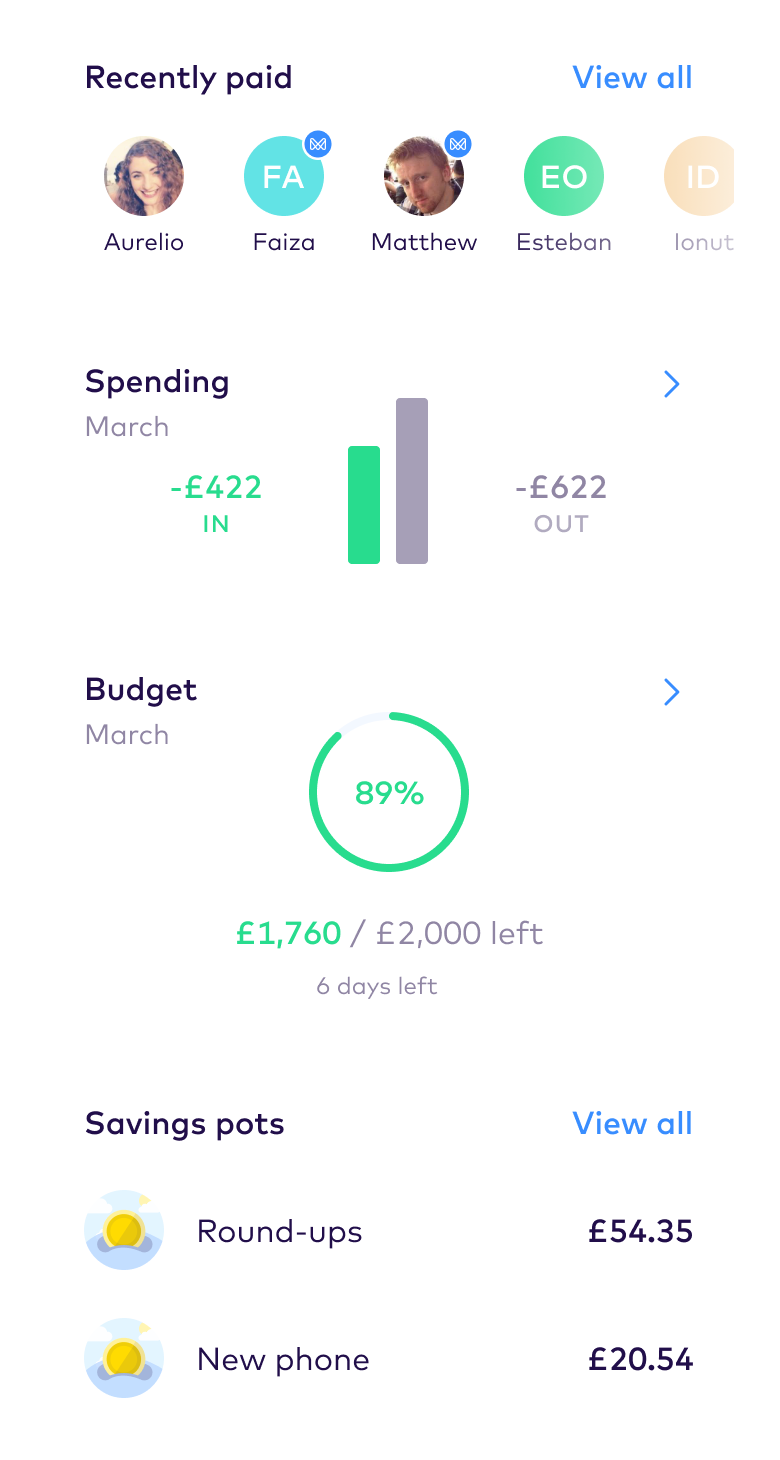

By bringing our financial tools to the heart of the Monese experience, we can help keep users in control of their finances, therefore better tailoring Monese to their needs and improving retention.

UX Strategy & research

Design Direction

User testing

Project management

A/B test analysis

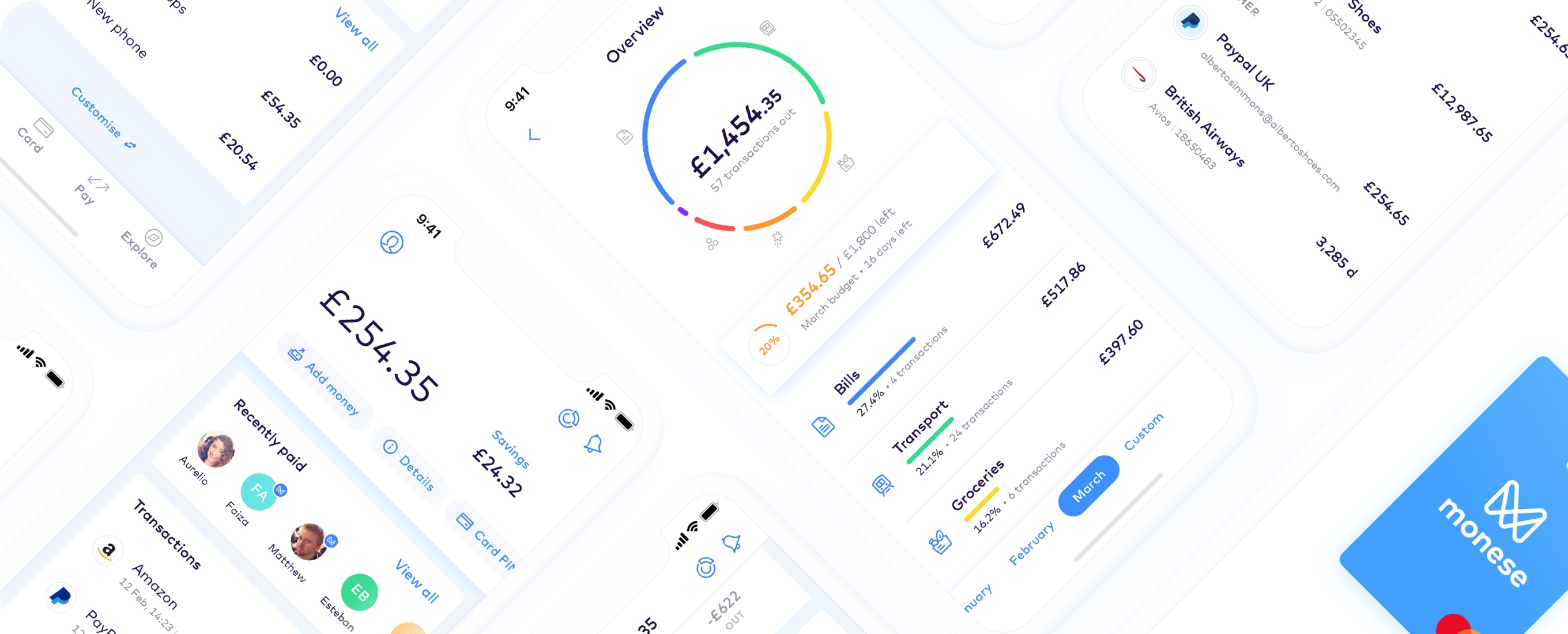

Where previously we had shown a continuous list of transactions, we introduced a set of insightful widgets to the homescreen. This allows users to get a better instant overview of their finances, and gain quicker access to the financial tools they use with Monese such as recent payees, spending insights, budgeting and savings.

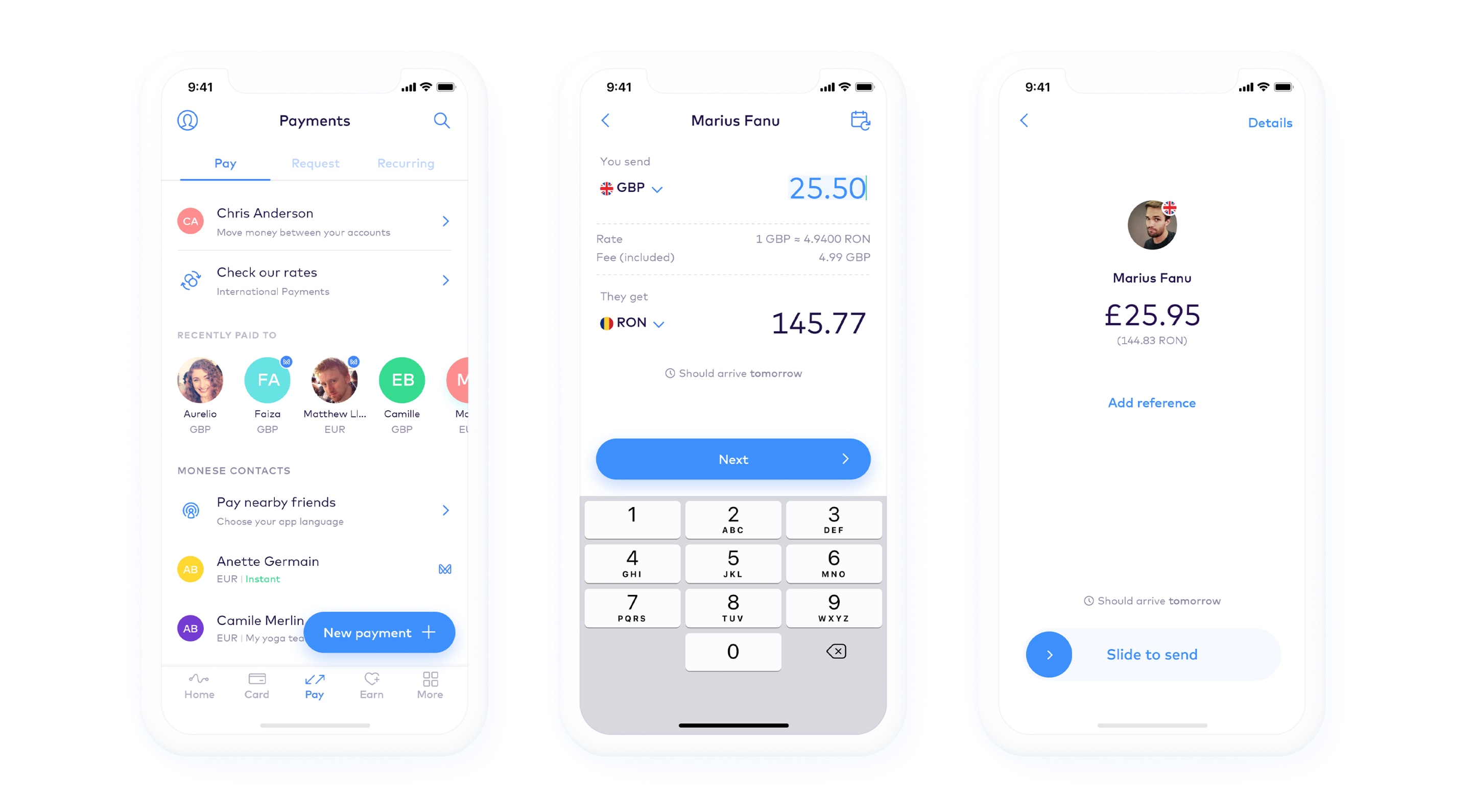

As a cross-border banking service, our customers needs have multiple use cases when it comes to paying another person or business. These span across both domestic and foreign exchange transfers in a variety of global currencies.

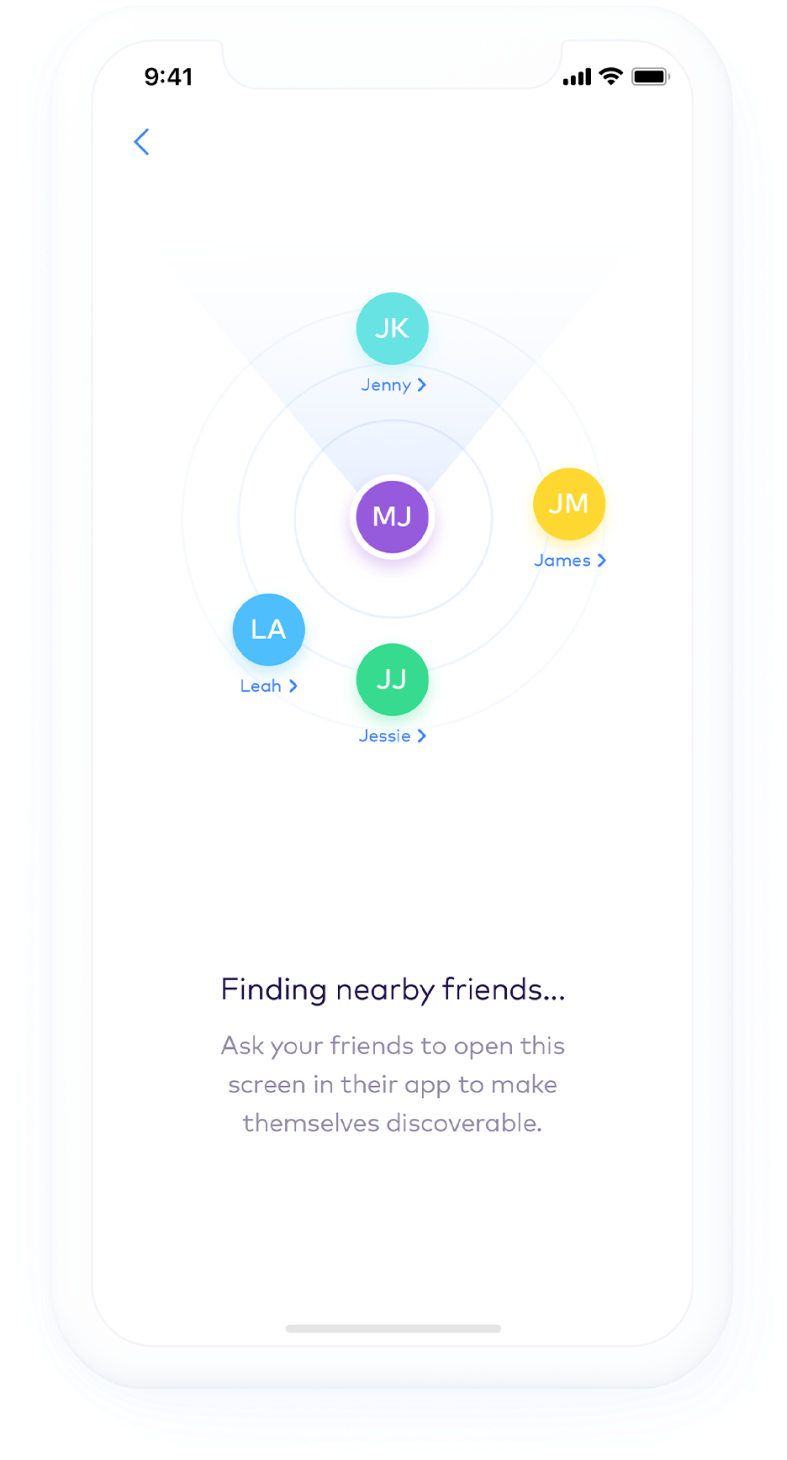

We built a versatile payments platform that allows users to quickly pay their most frequent payees in just a few taps, along with the ability to quickly find and pay those around them in their close proximity. Users can also make global foreign currency payments in 13 currencies, setup standing orders, request money from others and transfer funds between their own accounts.

Initial UX/UI design

Design Direction

Users commonly need to send money to friends they’re with in the same proximity. For example; being out with a friend for lunch who picked up the bill. Using bluetooth, customers can find other Monese users nearby and send money to them instantly in a couple of taps without needing to type in their bank account details.

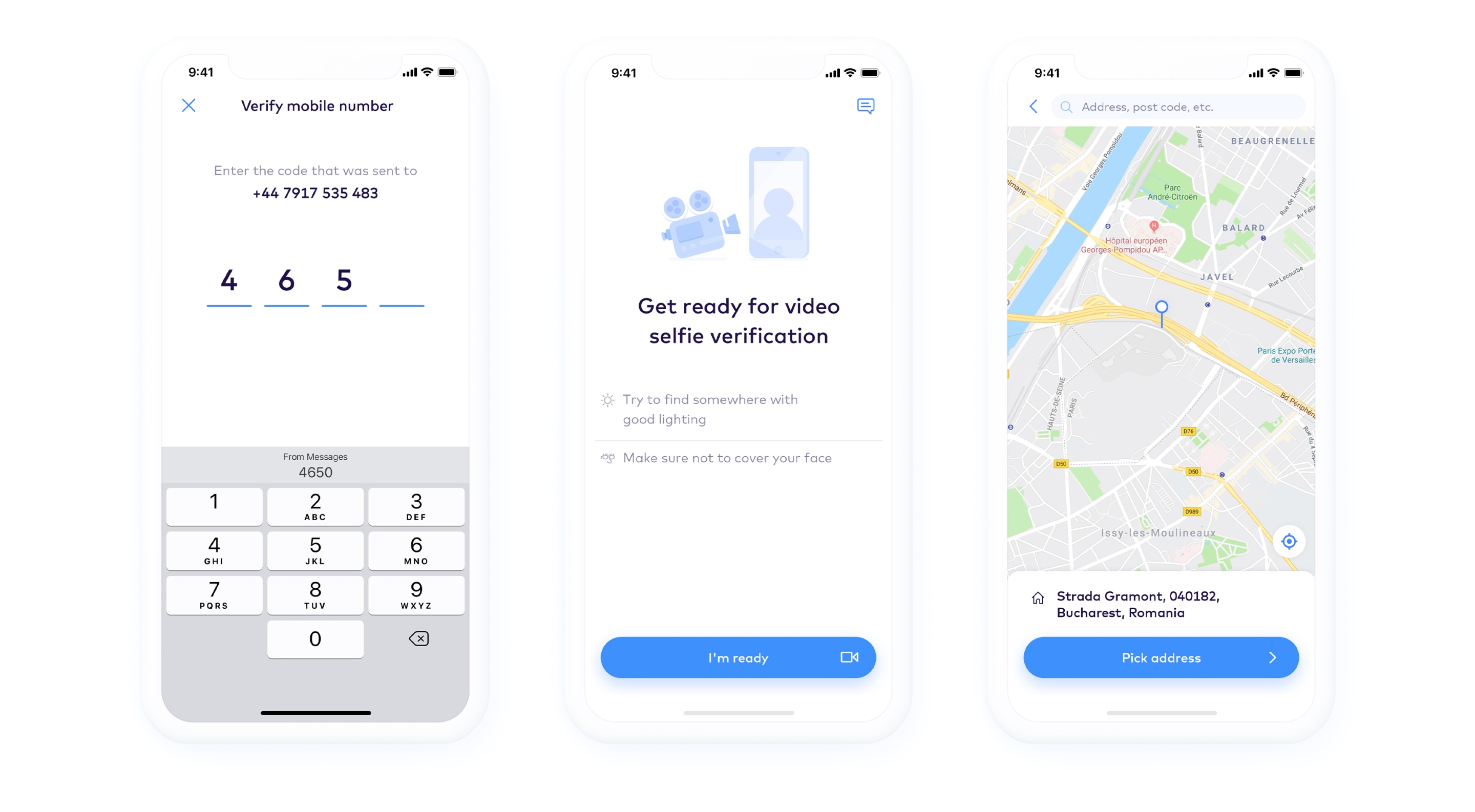

Our users are based across any of the 31 countries within the European economic area (EEA), and need a banking service that doesn’t require a lengthly proof of address or credit history. As a regulated banking service, we are however required to understand certain details about our customers to ensure that everyone is using the service in a way that complies with the law. This is referred to as ‘KYC’ (Know your customer).

We built a fast onboarding journey that guides the user through a series of checks including ID document scanning and a video selfie recording. Customers can choose to open a GBP, EUR or RON account, and select a pricing package that suits their usage needs. Users can complete the flow, order their debit card and topup the account in just a few minutes.

Initial UX/UI design

Design Direction

At the final stage of the onboarding journey, the user can select one of our 3 pricing packages that works best for how they would like to use their account. Alongside the list of plan benefits features a visual of our new vertical debit card design, tailored to represent each pricing package.